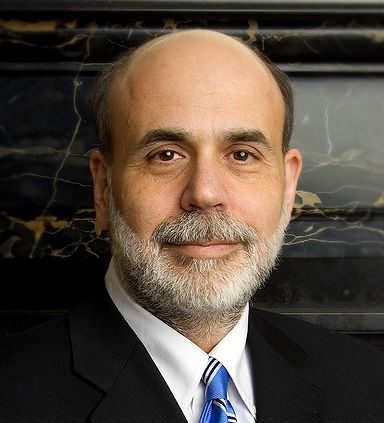

Federal Reserve Chairman Ben S. Bernanke was determined to assure lawmakers that the Fed can provide record stimulus and also limit inflation. He claimed that the Fed wouldn’t accept rising consumer prices in order to foster economic growth.

“It will be a similar pattern to what we’ve seen in previous episodes where the Fed cut rates, provided support for the recovery, and when the recovery reached a point of takeoff where it could support itself on its own, then the Fed pulled back, took away the punch bowl,” Bernanke told the House Financial Services Committee today in Washington.

Bernanke’s second day of testimony to Congress was met with disbelief, because lawmakers claimed that after lowering the Fed’s key interest rate to almost zero and pumping up its own balance sheet to a staggering amount of $2.87 trillion, there was little else the Fed–without printing huge amounts of money and causing inflation–might be able to do in order to help put the economy on a sounder footing.

Republican Representatives like Jeb Hensarling of Texas and Patrick McHenry from North Carolina, both openly disagreed with Bernanke. Patrick McHenry went even so far to suggest that Federal Reserve Chairman Ben S. Bernanke might even be inclined to tolerate inflation of 3 percent in order to spur the economy.

Ben Bernanke flat out rejected the idea of a three percent inflation target, because The Federal Open Market Committee couldn’t boost its 2 percent target for price increases “without losing control of the inflation process,” Bernanke said and he stated that: “I’m very skeptical that it would increase confidence among businesses and households and increase economic activity.”

Federal Reserve Bank of Chicago President Charles Evans was among the harsh skeptics and he suggested that Ben Bernanke should commit to low interest rates until the unemployment rate falls below 7 percent or inflation rises above 3 percent.

One of the many reasons why Bernanke’s claim that the Fed could boost the economy and still keep inflation at or even below two percent, was the fact that oil rose for a sixth day in a row and achieved the highest intraday level since May 30th, 2012 and settled at at $89.87 a barrel on the New York Mercantile Exchange.

When asked specifically about the inflation outlook, Ben Bernanke relied on prepared remarks and said “economic growth is slowing and inflation will probably remain at or below the Federal Reserve’s 2 percent objective after energy prices reversed their gains from earlier this year.”

In a nutshell, Federal Reserve Chairman Ben S. Bernanke merely survived the intensive two-day grilling by lawmakers, but his claims were greeted with mostly aggressive questions and met with reactions ranging from mild disbelief among Democrats up to ironic and partly hostile one’s by Republicans.

Like the Republican Representative Jeb Hensarling of Texas, who pointedly remarked that the economy suffered a “profound failure of monetary policy” because of the Fed’s unprecedented actions and because of Chairman Ben S. Bernanke’s blunt statement that the economic malaise would last at least until the end of 2014.